🚨 Redlining in L.A.: How a Big Bank Ignored Non-White Neighborhoods

In 2023, the U.S. Department of Justice (DOJ) made history with a huge settlement against City National Bank, a big bank based in Los Angeles. The bank is known as the “Bank to the Stars” because many of its customers are wealthy celebrities. But while it helped the rich and famous, it ignored entire communities of color.

🏠 What Happened?

Between 2017 and 2020, City National Bank did not open a single branch in any majority-Black or Hispanic neighborhoods in Los Angeles County. Even worse, it gave out very few home loans in those areas—even though many people lived there and wanted to buy homes.

The DOJ looked into this and found some big problems:

-

No branches in Black or Hispanic neighborhoods

-

Almost no home loans in those same communities

-

No outreach or marketing to people of color

-

Most loans went to white, wealthy neighborhoods

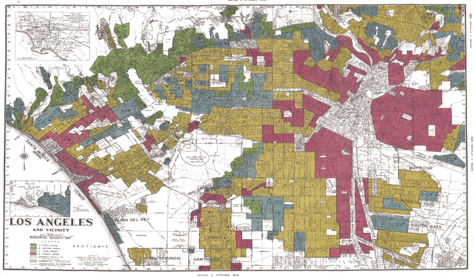

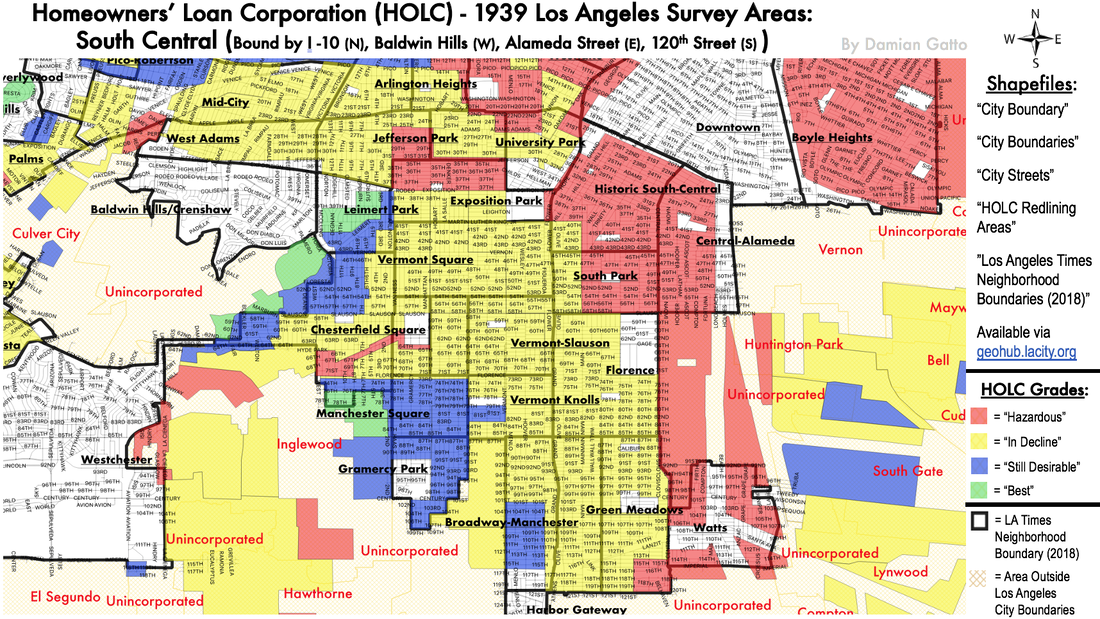

This is a modern example of redlining, a harmful and illegal practice where banks refuse to serve certain areas—usually based on race.

💸 What Was the Result?

City National Bank agreed to pay $31 million in a settlement. Here’s how the money is supposed to repair things:

-

$29.5 million will help Black and Hispanic families get home loans

-

$1.75 million will support education and outreach about fair lending

-

The bank also has to open new branches in underserved areas

-

They must hire new mortgage officers who focus on fair and equal lending

📢 Why This Matters

This case is the largest redlining settlement in DOJ history (at the time). It showed that even big, powerful banks have to follow fair lending laws. City National didn’t say it broke any laws on purpose, but the numbers showed clear neglect—and that can be just as harmful as open discrimination.

The message is clear: Everyone deserves a fair chance to own a home, no matter where they live or what they look like.

.png)